June 04, 2025

06/04/2025 CE: Privacy Liability, Regulatory Litigation Trends in the Cyber Industry

Date/Time: Wednesday, 6/4/25 12:00 to 1:00pm Topic: Privacy Liability, Regulatory Litigation Trends in the Cyber Industry Course Su...

June 02, 2025

National Safety Month: Why Roadway Safety Is Everyone’s Business

Creating a Culture of Care, On and Off the Job June is National Safety Month—a time to take a step back and think about what it really means to be safe. Not just within the four walls of a jobs...

May 30, 2025

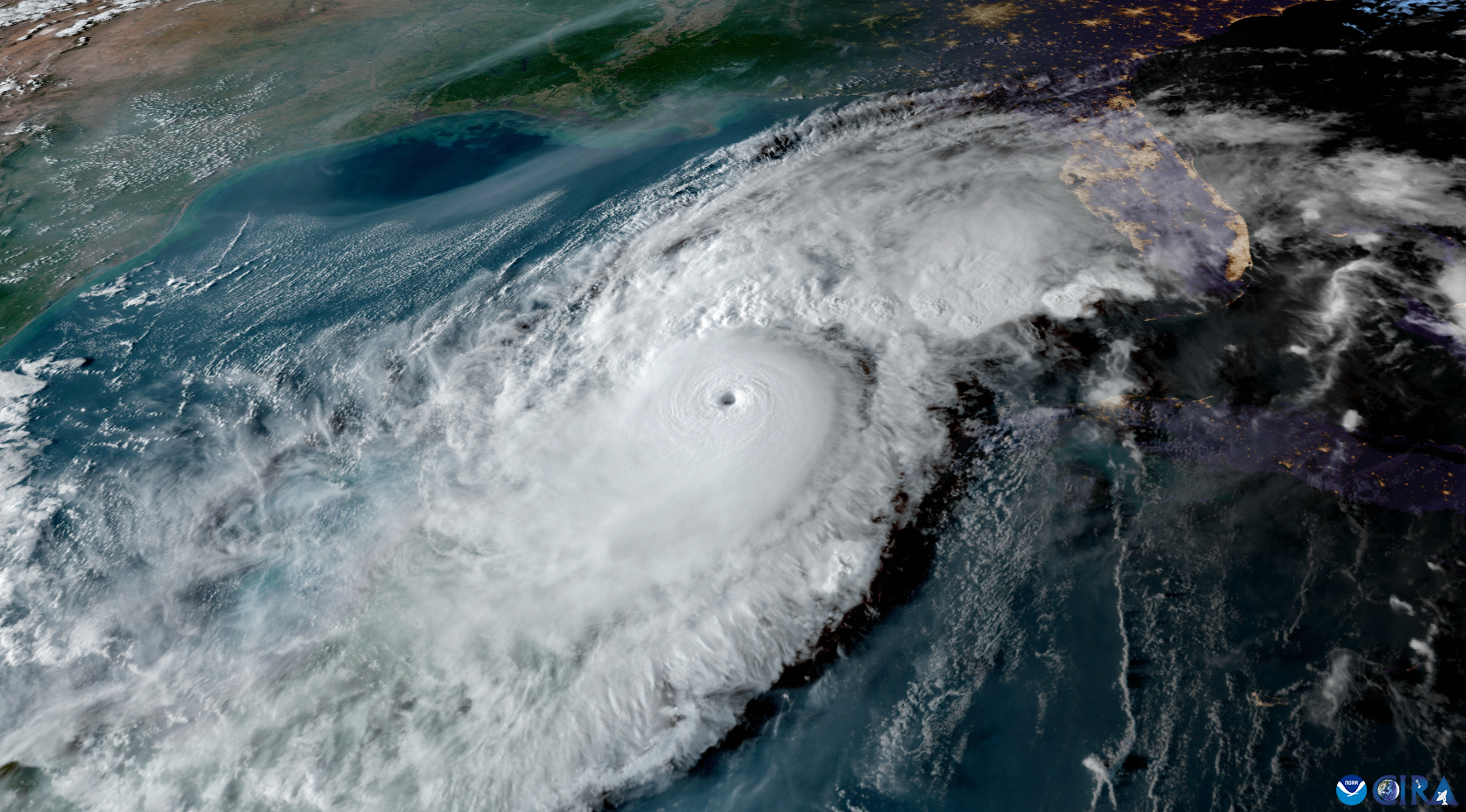

Be Proactive: Enhance Your Hurricane Preparedness for Optimal Risk Mitigation

Image of Hurricane Milton from NOAA's GOES-16 satellite on Oct. 8, 2024. (Image credit: NOAA) Each year hurricane season lasts from June through November. NOAA released its 2025 Hurrican...

May 16, 2025

Mental Health Awareness Month: Elevating Mental Health in the Workplace

May is Mental Health Awareness Month, a time for us to reflect on the importance of mental health and the vital role it plays in both our personal and professional lives. It’s essential to hire...

May 07, 2025

05/07/2025 CE: New York Construction & Labor Law

Date/Time: Wednesday, 5/7/25 12:00 to 1:00pm Topic: New York Construction & Labor Law Course Summary: The course will r...

April 11, 2025

Building Resilience: How Contractors Can Navigate Tariff Challenges

Graham Company Client Executive, John Dorsey, recently participated in a timely GBCA webinar focused on navigating the complexities of tariffs. In his discussion, John highlighted the critical need fo...

April 02, 2025

04/02/2025 CE: Health & Human Services Risk Management Fundamentals that Reduce the Total Cost of Risk

Date/Time: Wednesday, 4/2/25 12:00 to 1:00pm Topic: Health & Human Services Risk Management Fundamentals that Reduce the Total Cost of R...

January 14, 2025

In-House General Counsel Roundtable: Enterprise Risk Management, Corporate Governance Best Practices, Hot topics in Employment Law, Crisis Preparation and Management

Date/Time: Tuesday, January 14, 2025 8:00am to 2:00pm Topics:In House General Counsel Roundtable: • Enterprise Risk Management• Corporate Governance Best Practices• Hot Topics in Emp...

EB.jpg)

December 05, 2024

The Pendulum Swings Back: Navigating the Employee Benefits Landscape

The world of employee benefits is once again shifting. For the first time since the onset of COVID-19, the focus has pivoted back to cost containment—a stark contrast to the "everything under th...

December 03, 2024

Family Planning in the Modern Workplace: How Employers Can Enhance Family Planning Benefits to Boost Employee Well-Being

Family Planning Family planning encompasses a broad spectrum of considerations and support systems designed to help individuals and couples navigate the complexities of starting and growing a family....

November 05, 2024

Stay Cyber Safe: Holiday Shopping Tips for 2024

The holiday season is often referred to as the “Season of Giving,” but with the rise of cybercrime, it’s also becoming the “Season of Giving Away Personal Information.” A...

September 10, 2024

Is Your ‘‘Pay-If-Paid’’ Provision Sufficient As A Surety Defense?

Contractors, and their sureties, regularly rely upon what are called ‘‘pay-if-paid’’ provisions to mitigate financial risk and defend against payment claims. However, in ...

September 03, 2024

No One Is Immune: The Critical Importance of Cybersecurity and Vendor Management

In today's digital landscape, the interconnectedness of systems and the reliance on IT and cybersecurity vendors have created an environment where no organization is truly immune to potential disrupti...

June 13, 2024

Preventing Falls in Aging Services: A Comprehensive Approach

Preventing resident falls in aging services settings is a complex challenge, requiring a multifaceted approach tailored to each individual's needs. Falls can lead to severe injuries and a decline in t...

May 07, 2024

05/07/2024 CE: Contractual Transfer Risk Management Issues

Date/Time: Tuesday, May 7, 2024 12:00 to 2:00pm Topic: Contractual Transfer Risk Management Issues Course Summary: This edu...