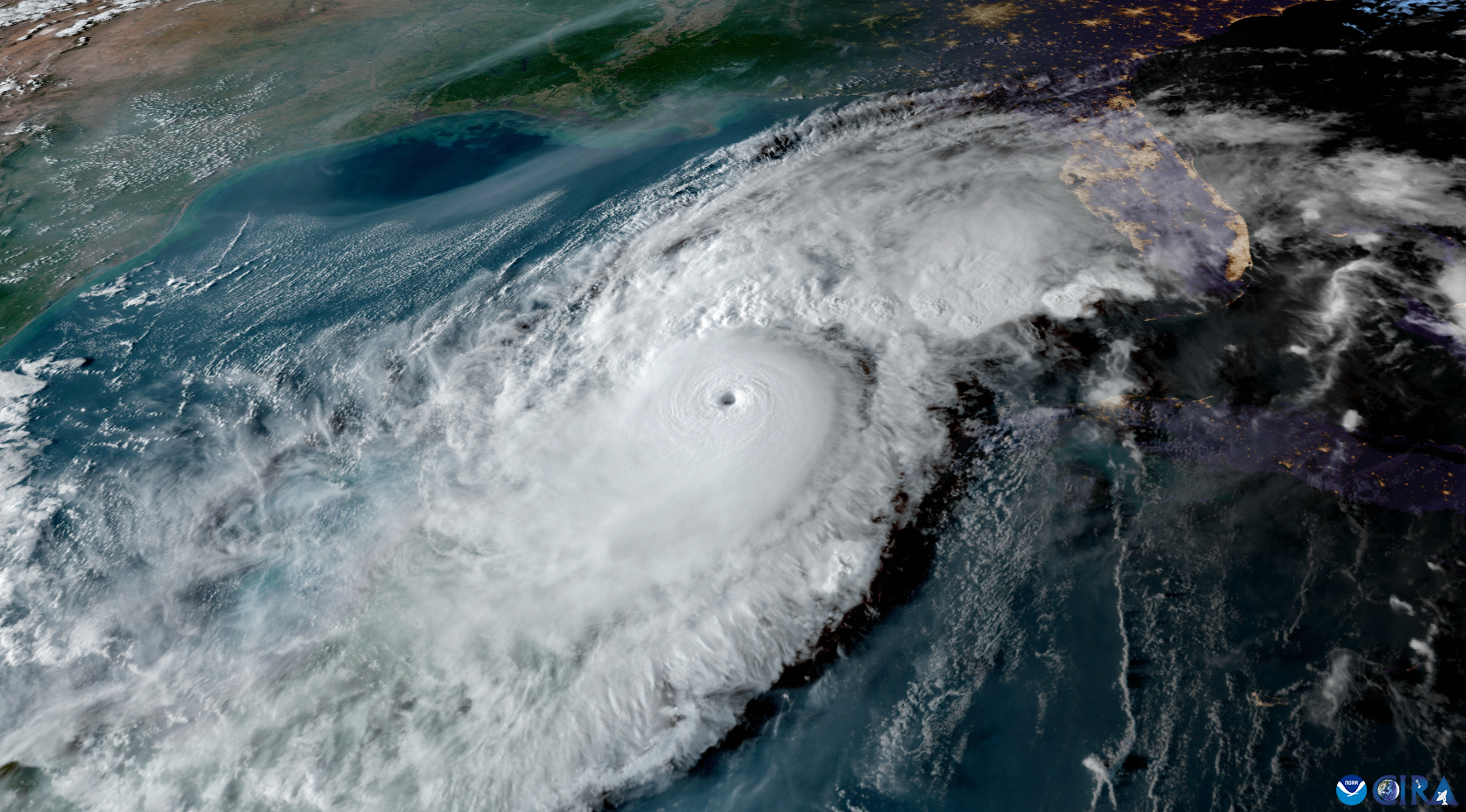

Between the destructive California wildfires and the damage caused by Hurricane Harvey and Hurricane Irma, 2017 was a record-breaking year for natural disasters. According to a recent report from the National Oceanic and Atmospheric Administration, the U.S. witnessed 16 severe weather and climate disaster events last year – with total costs exceeding $1.5 trillion.

In the wake of such widespread loss, many commercial property owners are proactively taking steps to reduce risk and ensure they have adequate coverage in place, should their property be affected in the future. However, for property owners that have leasing operations, there are additional expenditures that need to be considered, aside from just the costs associated with necessary recovery and repairs. For instance, what happens if a commercial property is significantly damaged and tenants are temporarily unable to inhabit the space? How can a commercial property owner recover with the added financial strain from losing rental income?

To help limit this exposure, many commercial property owners purchase rental income loss coverage, which is designed to cover the loss of rental income while the building is being restored. This type of extra expense policy is especially important if the property is located within an area prone to catastrophic perils – such as floods, earthquakes and windstorms – as it may also be a lender requirement. In many cases, this coverage can be added as an endorsement to a standard commercial property policy or in conjunction with business interruption insurance.

When purchasing rental income loss coverage for your business, it’s important to understand the fine print and details of the endorsement. For example, many common rental income loss policies only cover one month of rental income once the building has been repaired and is able to be occupied. Unfortunately, this can create an extensive gap in coverage if it takes more than one month to re-lease the building. In many cases, it actually takes several months to re-lease the property and reach pre-loss occupancy. To limit this exposure, property owners can also consider extended rental income loss coverage.

To ensure your property is protected and the correct policy with sufficient coverage limits is in place, it’s essential to work closely with your insurance broker to determine the specific risks facing your operation. Because rental income loss coverage is just one part of the commercial property policy, your insurance broker can help evaluate all policies as part of a larger strategy to create an overarching risk management program. This will help protect your business and your bottom line in the long run.

Philadelphia, PA, 19102

EB.jpg)